Tips to Find the Right Mortgage Lender

Rates and fees are important, but many factors come into play when finding the best mortgage lenders.

When it comes time to finding the best mortgage lenders, most homebuyers focus on concrete criteria – the interest rates, fees, and terms and conditions offered by different banks and credit unions.

Check your VA home buying eligibility. Start here (Jul 26th, 2024)

Rate isn’t the only factor that matters

Obviously, the loan’s total cost should be a key factor in determining the best mortgage and mortgage lender. But tangible factors aren’t the only things to consider. Some hard-to-quantify criteria may prove equally important. Here are sure-fire hacks that most people don’t think about when shopping for lenders.

When it comes to lenders, one size doesn’t fit all

Run a quick Internet search with the keywords “best mortgage rate,” and you’ll discover legions of lenders claiming to have the best deals. Are they all telling the truth or is this mostly hype? Yes and no.

Objectively speaking, there is no “best mortgage lender” for everyone. Every lender offers different products, services, and rates targeting different individuals and goals. The package that best fits your needs and timeline is the one you should choose. I can’t honestly say, “This or that financial institution usually has the best deals.”

For example, the company I work for, BECU, has a 12-year, no-fee mortgage. I love it because it’s so unique. To my knowledge, nobody else offers a 12-year, no-fee mortgage. That said, this mortgage isn’t right for everyone. To find exactly what you need, you’ll have to comparison shop. Don’t just choose the first mortgage or mortgage lender you come across.

There’s no rule of thumb for which lenders have the best rates and lowest fees. You have to look at which products they’re offering at the moment. Rates are constantly changing, and lenders are always looking at the market to price their loan products. At any given time, some banks attempt to generate more business, and (for various reasons like being over capacity) some actually want to discourage new applications. Find the companies that are really hungry for business and you’ll find better rates.

Consider the intangible factors

A lender’s reputation and size are also factors to weigh. Some people prefer to deal with smaller banks or credit unions in their communities, assuming they’ll receive more personalized service. Others prefer the solidity and reputation of big banks.

Another consideration is whether the bank or credit union will continue to hold your loan. These days, almost every mortgage lender sells its loans on the secondary market, but some continue to service the loan in-house or through a third party for the remainder of the term. The advantage to borrowers is that they aren’t dragged from one lender to another – between companies with different rules, policies, and levels of customer service.

For example, the initial lender might give you a loan with no prepayment penalties, but the second (or third or fourth) bank might penalize you for paying off the loan early. Or the loan might be sold to a company with poor customer service – one whose reps take their time responding to questions and problems. (On the other hand, the mortgage might be sold to a company with better customer service.)

Another key consideration is your comfort level with different companies and mortgage loan officers. How responsive is the loan officer to your needs? How quickly does he or she answer your questions and concerns? Does the person respond within hours, or does it take days … or even longer? Does the person seem to care about you, or are you just a number?

When people want quotes from me, I’ll get back to them the same day. I also make a habit of calling my clients a couple of times a week, if not more often. If a lender takes a week or longer to provide a simple quote, that’s a bad sign.

If you receive sluggish service, you may want to go with another lender. Ask yourself, “If it’s taking this long to get back to me with a simple quote, how long will it take to close the deal, especially if we encounter problems?”

Go with the lender that makes you comfortable in terms of being timely, knowledgeable and professional. If a loan officer takes forever to respond to you, contact a bank or credit union whose employees aren’t wading through hip-deep piles of paperwork.

Common home buyer mistakes

A common mistake made by homebuyers – and often the most costly – is paying for private mortgage insurance (PMI). This usually happens when the buyer hasn’t saved enough for a down payment of at least 20 percent. If necessary, defer your purchase (or purchase a smaller house) so you can make a big enough down payment to avoid PMI. Otherwise, you’ll be forced to add another $100 to $300 per month for the insurance.

Fortunately, VA loans do not require mortgage insurance. VA-eligible home buyers can qualify for a zero-down loan and often end up with a lower payment than a non-VA buyer making a significant down payment.

Another mistake is being unorganized. Be sure to have all the required documents available and lined up. Whenever you go through the home mortgage process, there is a time limit attached. If you’re so disorganized that the deadline passes, you’ll have to resubmit your documentation and start the process over.

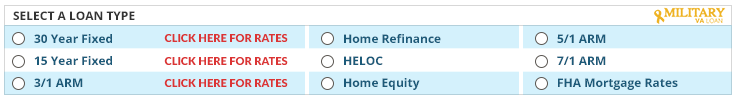

Comparison shop for rates

Finally, I can’t stress enough the need to comparison shop. Opening a mortgage loan is probably the biggest financial transaction you undertake in life. Take it seriously and shop as you would for a car, boat, or the house itself.

Although it’s common for real estate agents to recommend a favorite lender, don’t automatically choose that lender. That lender may have your agent’s best interests at heart, but not yours. Agents tend to pick lenders who close loans quickly.

If you want fast and speedy, that’s great, but slow and steady usually wins the race. Make sure your loan officer understands your goals and is working diligently to fulfill them.

Check your VA home buying eligibility. Start here (Jul 26th, 2024)